Are you tired of spending money just to manage your money? Finding a weekly budget app free that actually works can feel like striking gold. This comprehensive guide reveals the top 20 weekly budget app free solutions that will help you take control of your finances without spending a dime.

Quick Overview: Top 3 Weekly Budget App Free

- Mint: Best Overall Free Tracking

- Google Sheets: Most Flexible Option

- Personal Capital: Best for Financial Insights

Why Use a Weekly Budget App Free ?

Tracking your weekly expenses is crucial for financial health. A weekly budget app free can:

- Identify unnecessary spending

- Help you save money

- Provide real-time financial insights

- Reduce financial stress

- Build better money management habits

Who Needs a Weekly Budget App Free of Charge?

- Students on a tight budget

- Freelancers with variable income

- Young professionals

- Anyone looking to improve financial health

Top 20 Weekly Budget App Free Options

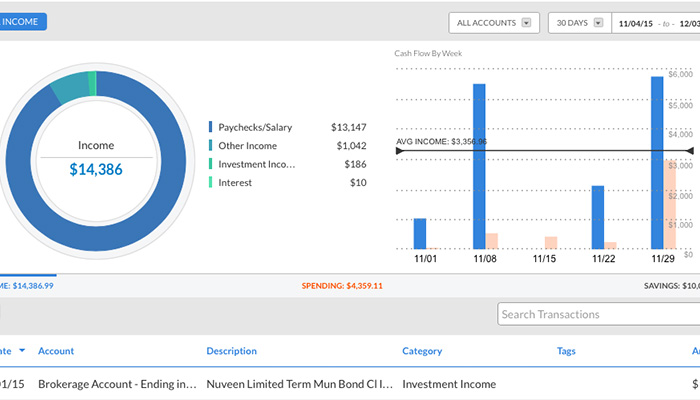

1. Mint: Best Overall Weekly Budget App Free

Key Features:

- 100% free weekly budget tracking

- Automatic expense categorization

- Real-time financial insights

- No-cost bank connection

Pros:

- Completely free

- Comprehensive spending overview

- Instant transaction tracking

Cons:

- Ads within the app

- Potential data sharing

Link: https://mint.intuit.com/

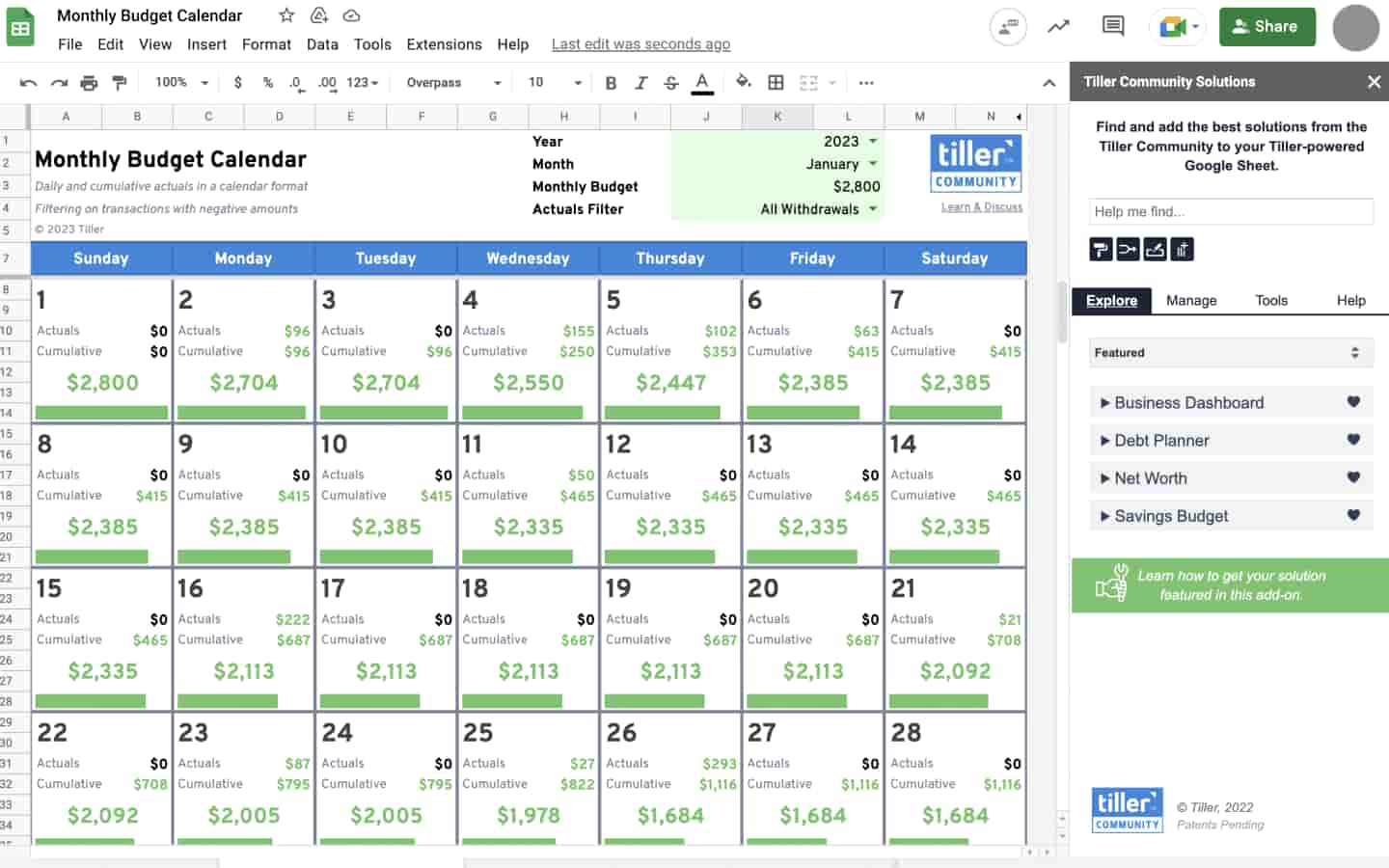

2. Google Sheets: Most Flexible Weekly Budget App Free

Key Features:

- 100% free

- Unlimited customization

- Cross-platform compatibility

- Manual tracking options

Pros:

- Total financial control

- No cost

- Works on all devices

Cons:

- Requires manual input

- No automatic tracking

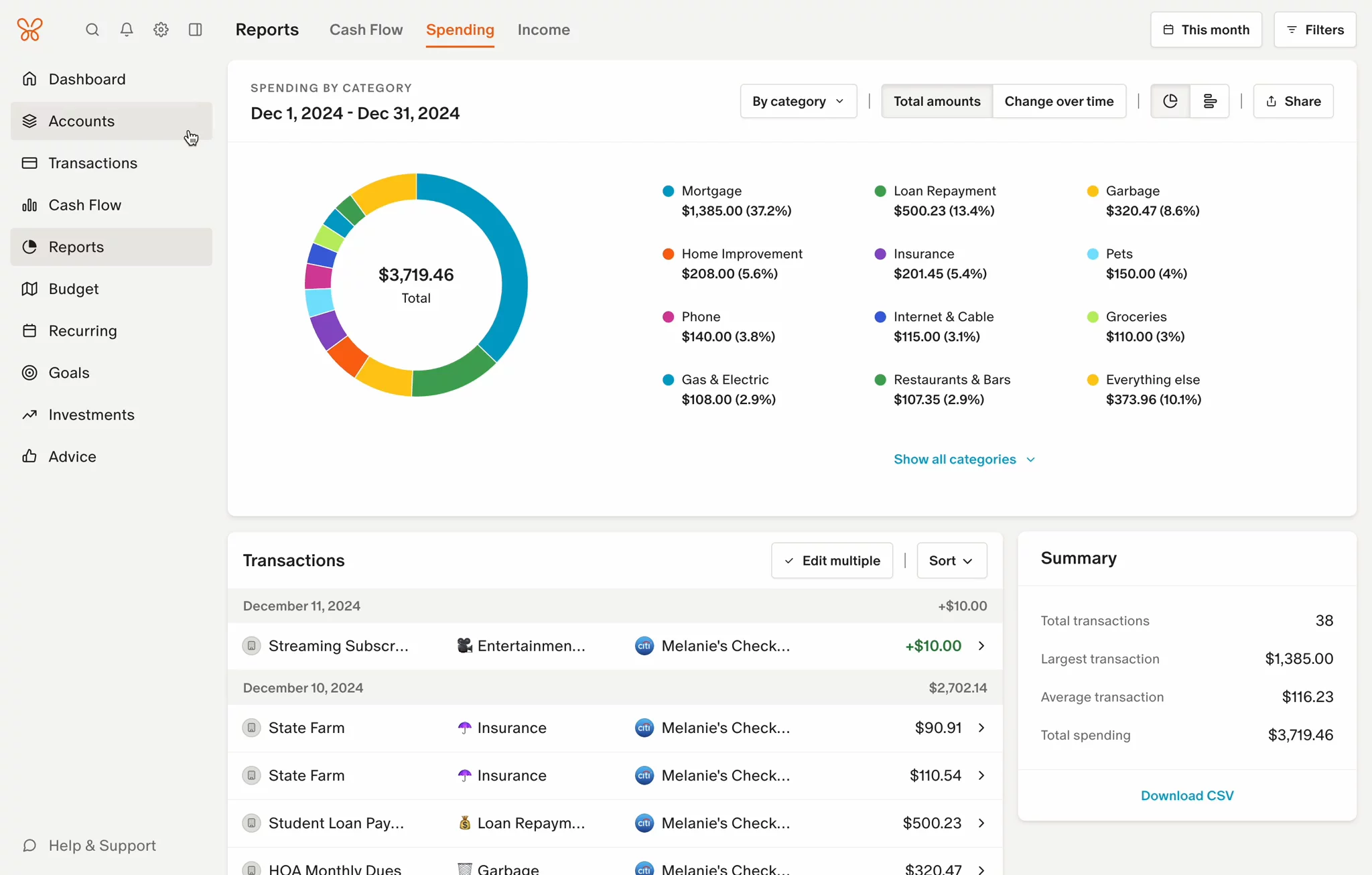

3. Personal Capital: Best for Investors

Key Features:

- Free financial dashboard

- Investment tracking

- Net worth monitoring

- Comprehensive financial view

Pros:

- Holistic financial insights

- Investment tracking

- No-cost overview

Cons:

- Complex interface

- Less detailed weekly budgeting

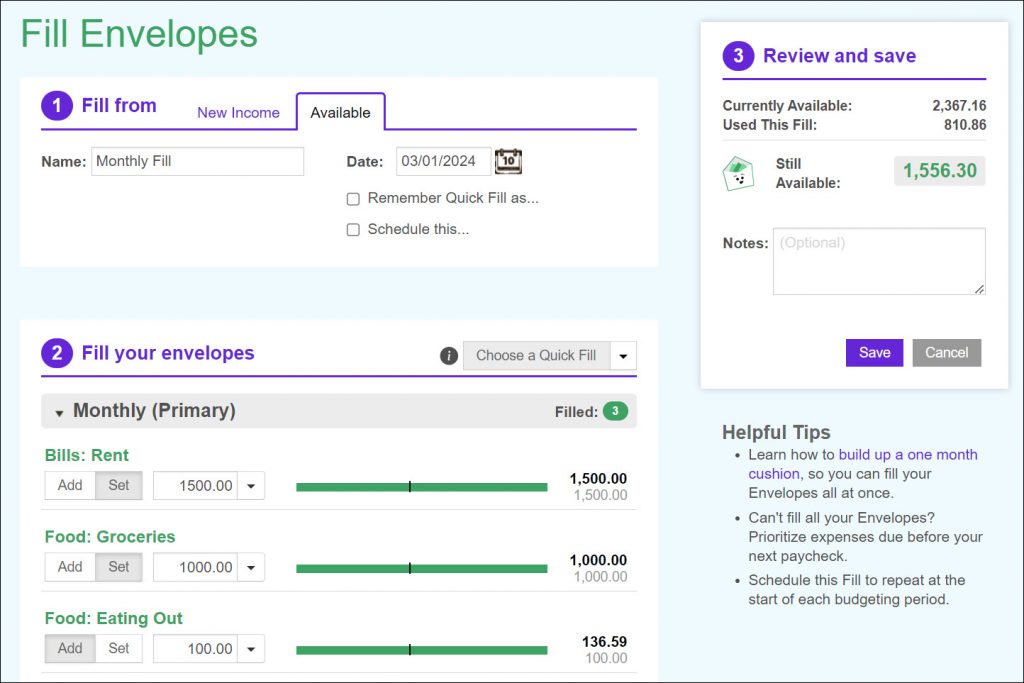

4. Goodbudget: Envelope Budgeting Method

Key Features:

- Digital envelope budgeting

- Free tier available

- Sync across devices

- Visual spending tracker

Pros:

- Intuitive envelope system

- Cross-device sync

- Free basic version

Cons:

- Limited envelopes on free plan

- Manual input required

5. Truebill (Rocket Money): Bill Tracking

Key Features:

- Bill negotiation services

- Spending analysis

- Subscription tracking

- Free tier available

Pros:

- Helps cancel unnecessary subscriptions

- Detailed spending insights

- No-cost basic tracking

Cons:

- Premium features require payment

- Limited free functionality

6. Clarity Money: AI-Powered Budgeting

Key Features:

- AI-driven financial insights

- Bill negotiation

- Spending tracking

- Free basic version

Pros:

- Intelligent recommendations

- Simple interface

- No-cost financial analysis

Cons:

- Limited free features

- Owned by financial institution

7. PocketGuard: Simplified Tracking

Key Features:

- “In my pocket” spending tracker

- Bill monitoring

- Savings goals

- Free version available

Pros:

- Shows available spending money

- Clean interface

- Quick insights

Cons:

- Limited free features

- Less detailed tracking

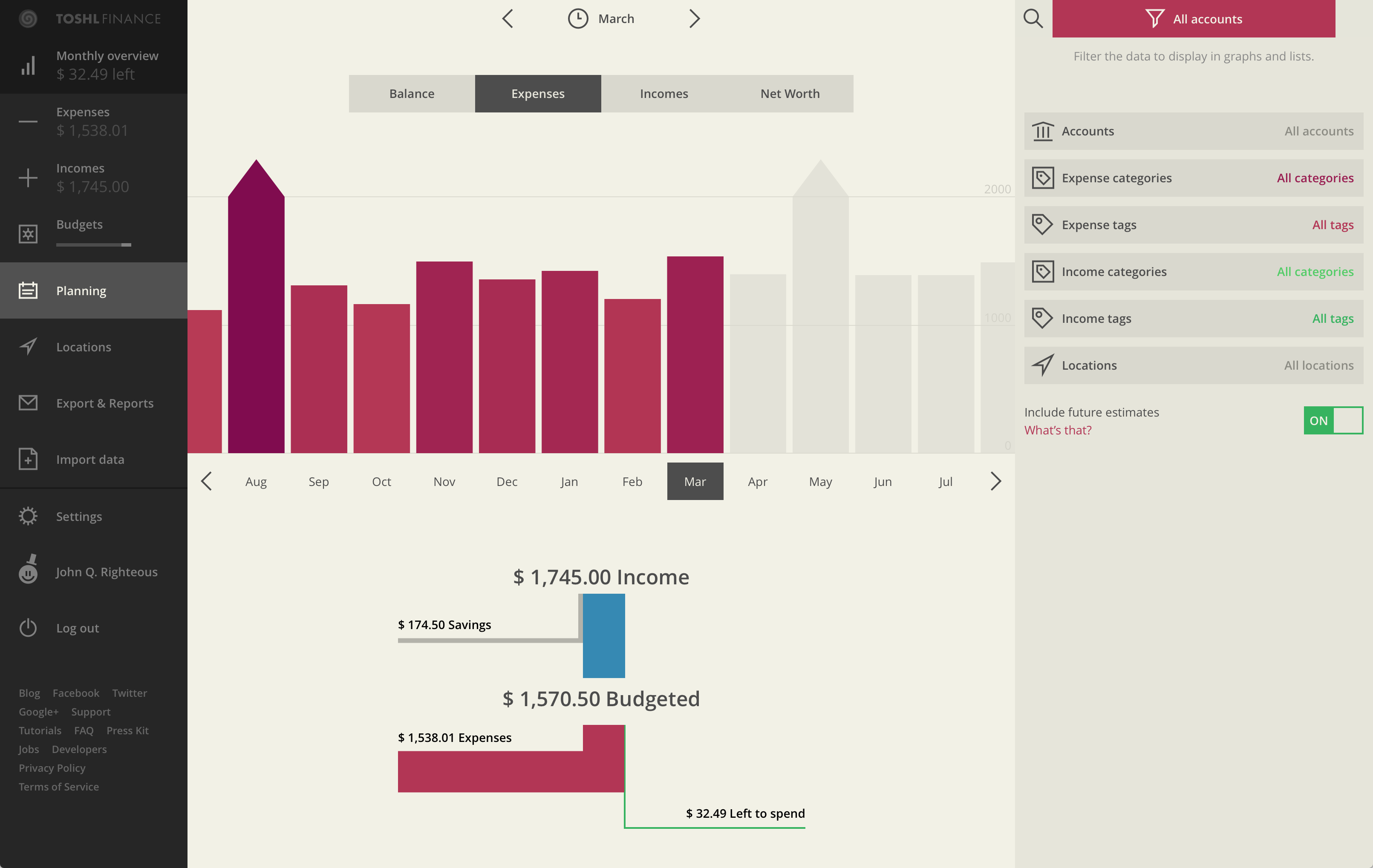

8. Toshl Finance: Global Budgeting

Key Features:

- Multi-currency support

- Expense tagging

- Free tier available

- Gamified budgeting

Pros:

- International user-friendly

- Fun interface

- Flexible tracking

Cons:

- Limited free features

- Less comprehensive

9. Mobills: Detailed Expense Tracking

Key Features:

- Detailed expense categorization

- Bill reminders

- Budget planning

- Free version available

Pros:

- Comprehensive tracking

- Bill payment alerts

- Multi-language support

Cons:

- Less popular globally

- Limited features

10. Walnut: Social Budgeting (Indian Market)

Key Features:

- Bill splitting

- Expense tracking

- Group bill management

- Free for users

Pros:

- Social expense sharing

- Local market focus

- No-cost tracking

Cons:

- Limited to specific market

- Less global functionality

11. Money Manager: Comprehensive Tracking

Key Features:

- Detailed expense categories

- Budget planning

- Multiple account support

- Free version available

Pros:

- Extensive customization

- Detailed reporting

- Multiple currency support

Cons:

- Complex interface

- Steeper learning curve

12. Fudget: Minimalist Budgeting

Key Features:

- Minimalist design

- Simple list-based tracking

- No account linking

- Free version

Pros:

- Privacy-focused

- No bank account required

- Simple to use

Cons:

- Manual input only

- Limited features

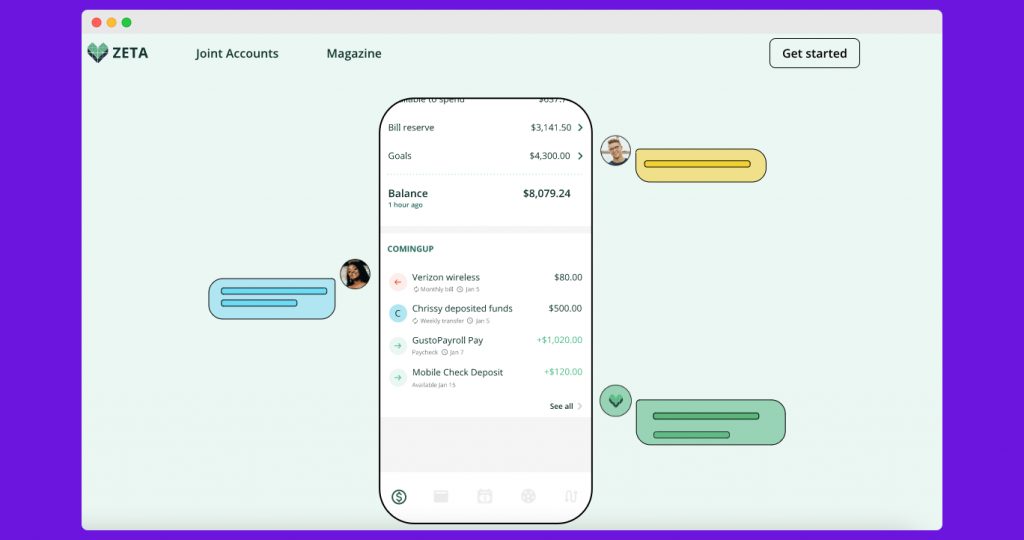

13. Zeta: Couples Budgeting

Key Features:

- Joint account tracking

- Shared financial goals

- Expense splitting

- Free basic version

Pros:

- Designed for couples

- Transparent financial sharing

- Goal-oriented tracking

Cons:

- Limited free features

- Couples-specific focus

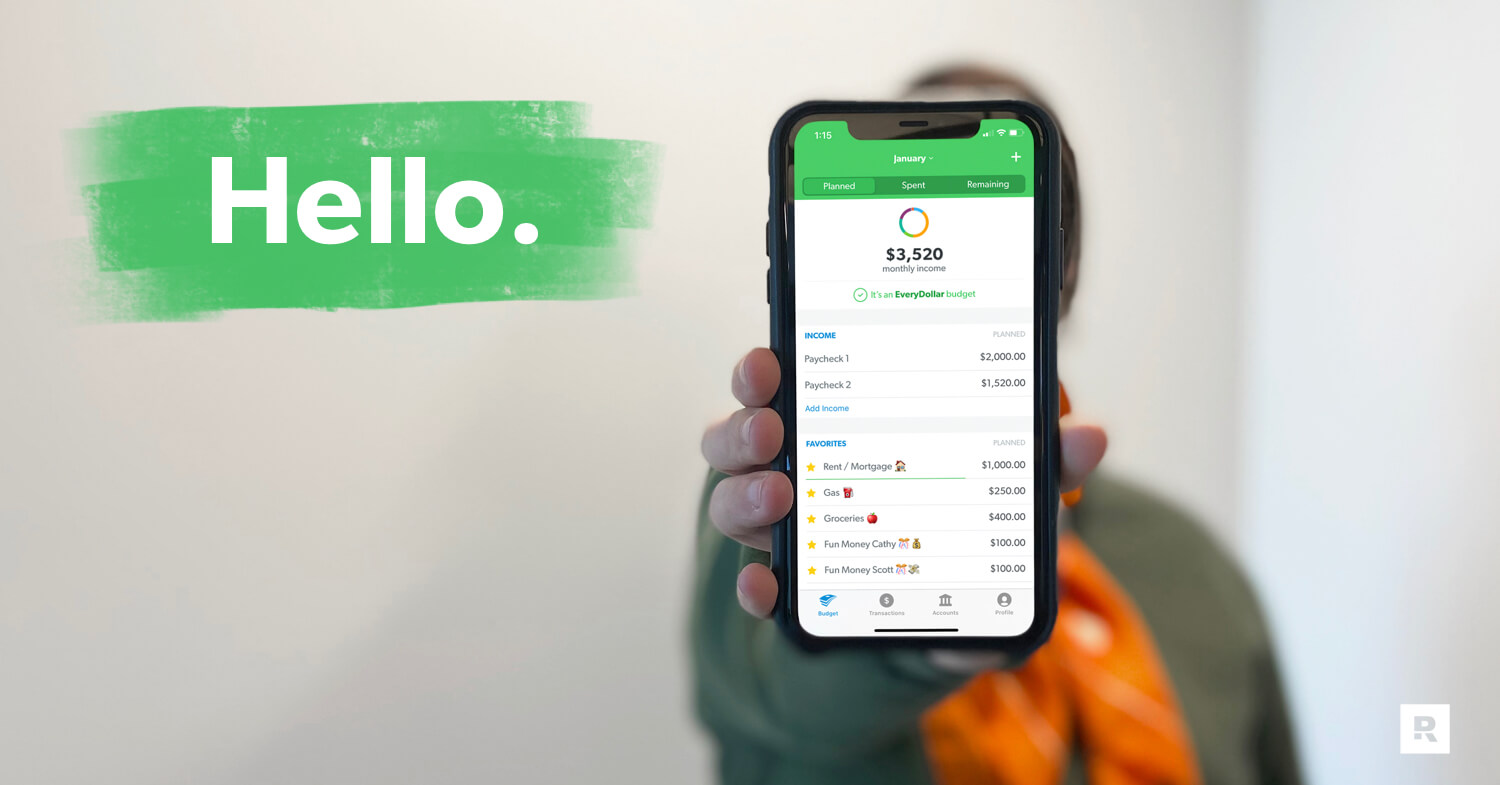

14. EveryDollar: Dave Ramsey’s Method

Key Features:

- Zero-based budgeting

- Goal tracking

- Free basic version

- Inspired by Dave Ramsey

Pros:

- Clear financial philosophy

- Straightforward budgeting

- Goal-oriented approach

Cons:

- Limited free features

- Manual input

15. Albert: AI Financial Assistant

Key Features:

- Automated savings suggestions

- Budget tracking

- Financial advice

- Free basic version

Pros:

- AI-powered insights

- Automatic savings recommendations

- Minimal fees

Cons:

- Limited free features

- Some premium services paid

16. Buxfer: Flexible Tracking

Key Features:

- Advanced budgeting tools

- Bill tracking

- Tag-based categorization

- Free basic version

Pros:

- Flexible expense tracking

- Detailed reporting

- Multiple account support

Cons:

- Complex interface

- Limited free features

17. Monarch Money: Comprehensive Planning

Key Features:

- Financial dashboard

- Investment tracking

- Budget planning

- Free trial available

Pros:

- Holistic financial view

- Detailed insights

- Easy-to-use interface

Cons:

- Limited free features

- Paid subscription for full access

18. CountAbout: Versatile Tracking

Key Features:

- Import transactions

- Custom categories

- Budget tracking

- Free basic version

Pros:

- Flexible transaction importing

- Customizable reporting

- Privacy-focused

Cons:

- Less intuitive interface

- Limited free features

19. Mvelopes: Digital Envelope Method

Key Features:

- Digital envelope budgeting

- Expense tracking

- Goal setting

- Limited free version

Pros:

- Intuitive envelope system

- Clear spending boundaries

- Goal-oriented approach

Cons:

- Very limited free features

- Requires active management

20. Digit: Automated Savings

Key Features:

- Automated savings

- Spending analysis

- Goal tracking

- Free basic version

Pros:

- Automatic savings

- Intelligent money management

- Easy to use

Cons:

- Limited free features

- Requires bank connection

How to Choose the Right Weekly Budget App Free Solution

Key Selection Criteria

- 100% free core features

- User-friendly interface

- Accurate expense tracking

- Platform compatibility

- Data privacy protection

3-Step Guide to Using a Weekly Budget App Free

- Choose Your App

- Download from app store

- Select free version

- Set up basic tracking

- Categorize Expenses

- Create spending categories

- Track essential expenses

- Monitor discretionary spending

- Consistent Tracking

- Input all expenses weekly

- Review spending patterns

- Adjust budget as needed

Common Challenges Solved by Weekly Budget App Free

Budgeting Struggles Addressed

- Limited Money: Zero-cost solutions

- Lack of Time: Quick setup and tracking

- Financial Confusion: Clear spending insights

- Overspending: Instant expense tracking

Frequently Asked Questions

Are These Weekly Budget Apps Completely Free?

Yes! Core features are free. Some offer optional premium upgrades.

How Much Can I Save Using a Free Budget App?

Most users save $100-$300 monthly by tracking expenses.

Are Free Budget Apps Safe to Use?

Reputable apps use bank-level encryption. Always review privacy policies.

Pro Tips for Maximizing Weekly Budget App Free

- Track Every Expense

- Record all spending

- Be consistent

- No expense is too small

- Set Realistic Categories

- Create specific spending groups

- Allow flexibility

- Review and adjust monthly

- Use App Alerts

- Set spending notifications

- Monitor budget in real-time

- Stay informed about financial health

Final Verdict: Best Weekly Budget App Free

Mint remains the top weekly budget app free, offering comprehensive tracking without cost. Google Sheets provides an unbeatable free alternative for those wanting total customization.